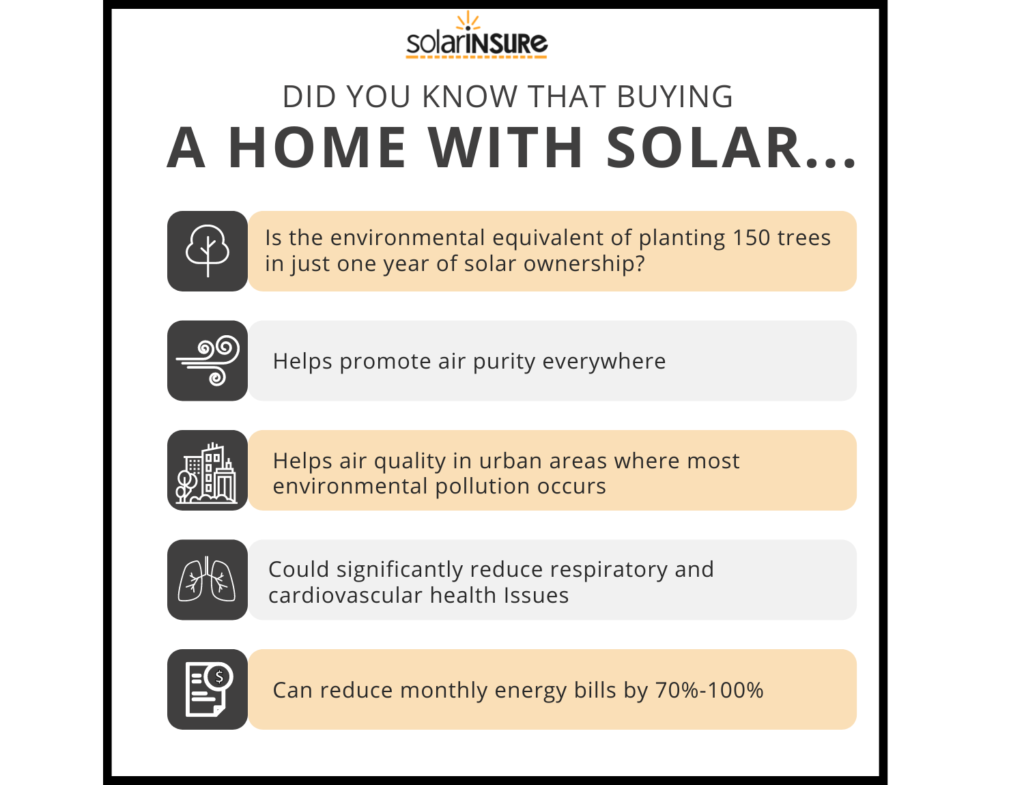

Installing solar panels on your home represents a significant investment that can provide long-term savings on energy bills and environmental benefits. However, owners risk substantial financial losses from weather events, theft, vandalism, or accidental damage without adequate insurance protection.

As solar energy adoption grows exponentially across the United States, homeowners must understand the risks and work with insurance providers to ensure their solar systems have comprehensive coverage.

Table of Contents

Why Solar Panels Require Specialized Insurance Considerations

Unlike appliances or other home systems, solar panels are unique in several ways that standard insurance policies may not address:

Location and Installation – Panels are mounted outdoors and installed across large surface areas on various parts of your home or property, exposing them to weather events.

High-Value Equipment – From photovoltaic cells to inverters and batteries, solar systems contain expensive technology that thieves can target.

System Size – Solar installations can stretch across acres of land, requiring coverage based on capacity, not just panel count.

No Standardization – With numerous panel manufacturers and system configurations, insurance criteria can vary greatly between providers.

Long-Term Assets – Solar panels are expected to function for 25-30 years, requiring lifelong coverage of your asset.

Utilities Interdependence – Grid-connected systems have complex interactions with utilities that must be addressed if outages occur.

Evaluating Homeowners Insurance for Existing Coverage

Solar panels may automatically qualify as covered property without adjustments for homeowners with standard insurance policies. However, you must confirm the following with your provider:

Coverage of solar equipment as “building property” – panels attached to your home/land typically apply but may have limits.

The value of solar system covered – ensure coverage caps exceed your total investment.

Type of perils covered – assess exclusions for weather, theft, vandalism or accidents.

Special procedures after claim events include preventing hazards and isolating damaged system components.

Effect of Solar Installation on Premiums

Adding solar panels may impact your premiums and require changes to your coverage limits. Be transparent about your system details so your insurer can evaluate risks and costs properly.

System Size – Large installations represent higher potential repair/replacement costs factored into premiums.

Location – Panels installed in exposed areas or severe weather regions can heighten risk profiles.

Safety Features – Things like lighting, fencing, and video surveillance can reduce risks of damage or theft.

Claims History – Prior solar damage claims may increase your policy rates.

Farming or Commercial Solar Insurance Policies

More than homeowners insurance is required for industrial, agricultural, or larger-scale solar projects. Instead, commercial solar owners will require tailored policies addressing unique needs:

Higher Value Systems – Large operations can have multi-million dollar solar investments requiring equally substantial coverage.

Specific Perils – Commercial policies specify protection for financial losses from events like failed grid connections or solar component defects.

Business Interruption – Lost income from solar system downtime can be covered for enterprises relying on solar-generated power.

Liability Risks – Solar array damage on commercial property poses risks to employees/visitors also covered under policies.

Equipment Financing – Loans or leasing for projects may mandate insurance policies to protect stakeholder investments.

Insurance Considerations by Solar Market Sector

Solar projects across market sectors like residential, commercial, industrial, and utility-scale have distinct insurance profiles shaped by system size, location, regulations, and other variables.

Residential Solar Insurance

Homeowner policies traditionally cover small-scale home installations, but verification is crucial. Increased structure/content limits and lower deductibles are advised.

Additional riders may be prudent, covering risks like alternative energy equipment, seepage/leakage from panels, etc.

Umbrella insurance can provide additional liability protection as system issues could spark home fires or other building damage.

Farm/Commercial/Industrial Solar Installations

Commercial general liability policies offer core coverage, but augmented property insurance covering solar equipment is essential.

Rainwater runoff from panels may require environmental liability coverage under pollution insurance policies.

Workers’ compensation and builders’ risk,insurance are factors for large solar projects.

Utility-Scale Solar Farms

Operators or co-owners of solar farms require highly customized policies addressing weather risks, component defects, transmission grid issues, and liability exposures.

Environmental pollution, aviation liability, equipment breakdown and cyber risks also need evaluation.

Substantial insurance reserves from operators must back performance guarantees protecting project investors and revenue delivery assurances.

Warranties & Service Agreements for Solar Projects

While essential, insurance coverage works in tandem with other protections for solar investors:

Equipment Warranties – Manufacturers guarantee against defects and degradation in panel and component quality. Performance warranties typically cover 10-12 years at 80% efficiency, extending to 20-25 years at lower efficiency levels. These guard against internal system issues but not external risk events.

Workmanship Guarantees – Solar contractors offer separate guarantees covering flaws in design building, installation, and operational soundness for 1-2 years. Insurance claims from installation problems can still occur after that.

Operations & Maintenance Plans – Long-term O&M services help optimize solar production and minimize equipment faults. They complement warranties but represent an added cost.

Insurance policies fill gaps between these self-contained manufacturer commitments and contractor guarantees, shielding owners from uninsured liabilities over the system’s lifespan.

Claims Handling Process for Solar Panel Damages

Despite preventative measures, unforeseen solar damage events still occur, requiring claims administration. Understanding how these cases are resolved ensures you get proper restitution:

First Notice – Initial insurance claim notification should note the date, geographic area, preliminary damage description, and contact details. Photos/video documentation is beneficial.

Loss Assessment – Insurer representatives will inspect affected equipment and site damage firsthand and may engage forensic investigators as warranted. They determine if claimed issues stem from covered policy events.

Claims Valuation – Once an approved claim is deemed, the insurer calculates repair/replacement costs, factoring expenses like permitting, system commissioning, structural building fixes, electric code upgrades, and hazardous waste removal.

Claims Settlement – After agreeing to scope and valuation, the insurer issues claim payment checks or coordinates directly with your chosen solar restoration contractors.

Dispute Mediation – For claim rejections or disputes on factors like the extent of damage, quality of repairs or payment amounts, solar insurance policies have structured mediation processes to secure equitable resolutions.

Takeaways: Prioritizing Tailored Solar Panel Insurance Early On

Solar Panel Insurance will inevitably represent added costs for solar power system owners. Still, it can determine the very survival of these investments after major weather disasters, theft and vandalism episodes, or component safety failures.

By securing coverage aligned with the uniqueness of solar projects early on, residential households and commercial operators gain vital financial protection for their renewable energy goals and sustainability commitments. Consult with specialized solar insurance agents and broker partners to map prudent programs benefitting your specific solar installation endeavors.

Comments are closed.