Last Updated:

The solar industry experienced exponential growth over the last decade as costs fell and favorable policies helped drive mass adoption.

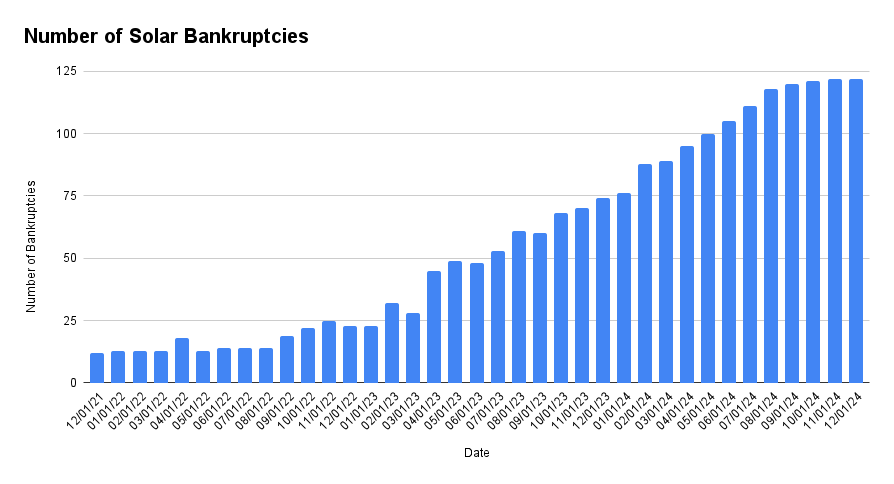

However, 2024 has brought immense challenges, with higher interest rates, tighter financing, and adverse policy shifts in key states contributing to over 100 solar bankruptcies based on our industry data, a number unseen before in our almost 20 years in the solar sector.

California was particularly hard hit due to new net metering rules under NEM 3.0 that radically reduced system economics.

These adverse state policy impacts exacerbated financing shifts, triggering plummeting demand and an 80% decrease in rooftop solar installation volume. The California Solar & Storage Association reports that the fallout includes thousands of stalled projects, over 17,000 industry layoffs, and a wave of high-profile bankruptcies.

While stronger players demonstrate some resilience, impacted homeowners and solar employees face prolonged uncertainty. The outright collapse of many once fast-growing solar firms provides a sobering case study on the potential unintended consequences of incentive transitions.

Table of Contents

Major Solar Contractors That Went Out of Business

Major Solar Bankruptcies as of January 2026 Include:

- Sunnova – Multiple States

- SunPower – Multiple States

- Pink Energy – Multiple States

- MC Solar – Modern Concepts – Florida

- Harness Power – California

- NM Solar Group – New Mexico

- ASA – American Solar Advantage – California

- Kuubix Energy – California

- Erus Energy – Arizona

- Infinity Energy – California

- Suntuity Renewables – Per Sunova – NJ, CA , TX

- ADT Solar – Multiple States

- Vision Solar – Multiple States

- Solcius – CA, NM, AZ, NV

- Sunworks, Inc. – CA

- Kayo Energy – AZ, CA, TX, FL

- iSun – CT

- Titan Solar Power – Multiple States

- Lumio Solar – Utah

- Expert Solar – Florida, Texas

- Shine Solar – LA, AK

- Posigen – Multiple States

- Pure Light Power – Multiple States

California Company Closures:

- Altair Solar

- ASA – American Solar Advantage – CA

- Bratton Solar- CA

- Canapoy Energy – CA

- Charged Up Energy – CA

- Enver Solar – CA

- Harness Power – CA

- GCI Solar – CA

- Green Nrg – CA

- Kuubix Energy – CA

- Peak Power USA – CA

- Penguin Home- CA

- Polar Solar – CA

- Professional Roofing and Solar – CA

- Sigora Home Solar – CA

- Solsun USA – CA

- Solar 360

- Solar Advantage – CA

- Sullivan Solar Power – CA

- Sungrade Solar – CA

- SunPower – CA

- Sunstor Solar – CA

- RGS Energy – CA

- Solar Spectrum – CA

- Sunworks, Inc. – CA

- Swell Energy – CA

- United Solar Inc. – CA

Texas Company Closures:

- Alternative Solar

- American Sun

- Daybreak Solar Power

- Cosmo Solaris – DBA WNK Associates , Under Investigation

- Envirosolar

- Hitech Solar

- Integrity Solar

- Next Energy

- Nivo Solar

- Speir Innovations

- TES Home Solar

- Texas Solar Broker LLC

- Texas Solar Integrated LLC

- Verisolar

- Vulcan Solar

Other States:

- 3D Solar – Florida

- AAA Certified Solar – Nevada

- Accept Solar – MA

- ACE Solar Systems – AZ

- Arizona Solar Concepts – AZ

- Brimma Solar – WA

- Code Green Solar – NJ

- EcoMark Solar – CO

- Elan Solar – UT

- Electriq Power – FL

- Encor Solar – UT

- Gulf South Solar – LA

- Moxie Solar – IA

- Refresh Energy Group – CO

- Saveco Solar – UT

- Solar Is Freedom – OH

- Solar Direct – FL

- Solar Titan USA – TN

- SolarDot – FL

- Solarworks – AZ

- Solular, LLC – NJ

- Utah Solar Group – UT

- Voltage Solar Power – FL

- Zenernet – AZ

Why Solar Companies Go Out Of Business

In 2023 – 2025, the solar industry experienced a significant number of contractors going out of business, a trend driven by a confluence of economic and policy-related factors.

Higher Interest Rates

Federal Reserve’s Rate Hike: The Federal Reserve raised interest rates to combat inflation, inadvertently affecting the solar sector. Higher interest rates have made borrowing more expensive, discouraging consumers from investing in solar energy systems. This drop in consumer demand hit solar contractors hard, as their business model relies heavily on a steady flow of new installations.

Consumer Sentiment and Solar Investments: With increased borrowing costs, the allure of solar energy as a cost-saving investment diminished. Potential customers became more hesitant to undertake large expenditures, especially for systems perceived as long-term investments.

Escalating Working Capital Costs

Borrowing Challenges for Solar Companies: Solar contractors typically rely on borrowed capital to finance their operations and projects. The rise in interest rates significantly increased their cost of capital. This surge in working capital costs strained their financial resources, leading to cash flow issues and, for some, insolvency.

Impact on Small and Medium Contractors: Smaller contractors, in particular, struggled to absorb these increased costs, lacking the financial buffers of larger firms. This disparity led to a disproportionate impact on these smaller players, many of whom were forced to close their doors.

Changes in Solar Lending Practices

A shift in Milestone Payments: Solar lenders, responding to the riskier financial environment, altered their payment structures. Previously, contractors received payments at various project milestones M1, M2. M3, depending on the state of the solar installation. Generally, full payment was obtained from the lenders during M1 and M2 which was after the installation was complete. Now, lenders typically delay full payment to M3, which is PTO. The new structures delayed these payments, exacerbating cash flow challenges for contractors.

Balance Sheet Stress: These changes placed additional pressure on the balance sheets of solar contractors. The delayed cash inflows hindered their ability to manage operational expenses and invest in new projects, leading to a vicious cycle of financial stress.

Policy Shifts and Their Consequences

Case Study: NEM 3 in California: California’s Net Energy Metering (NEM) 3 policy is a prime example of policy impact. This policy revision reduced the net metering rates paid to solar consumers, extending the payback period of solar investments.

Effect on Consumer Decisions: The reduced financial attractiveness of solar investments under NEM 3 made consumers reconsider solar installations. This policy change directly impacted contractors’ business, as California is one of the largest solar markets in the U.S.

Understanding the Impact of Solar Bankruptcies

The closure of numerous solar contractors in 2024 has sent ripples through various facets of the solar market, affecting customers, ongoing projects, and the industry.

Impact on Customers and Projects:

- Homeowners with ongoing installations face uncertainty and potential delays.

- Customers amid warranty or service agreements may find themselves without support.

- The reduction in active contractors could lead to less competition, potentially impacting pricing and service quality in the short term.

Solar Market Dynamics:

- These closures could temporarily slow down the rate of new solar installations.

- The supply chain for solar components might experience fluctuations due to altered demand patterns.

- Industry consolidation might occur, with larger players absorbing defunct companies’ client base and assets.

Homeowner Concerns:

- Homeowners may worry about the longevity and maintenance of their solar systems.

- Questions around warranty claims and service continuation are prevalent among those whose contractor is on the closure list.

What Homeowners Can Do About Solar Bankruptcies

For homeowners affected by these closures, there are several steps to mitigate the situation:

- Warranty Claims and Service Continuations:

- Review your contract for warranty details and any clauses about service disruptions.

- Contact the manufacturer of your solar panels or system components for warranty support.

- Seek alternative local contractors who might take over service agreements.

- Utilizing Solar Insure’s Extended Warranty Product:

- Solar Insure offers an extended warranty product that includes monitoring and service for unsupported homeowners.

- This warranty can be a safety net, providing peace of mind and ensuring system upkeep.

In addition, there are several documents that solar homeowners should ensure they have on file in case their installer goes out of business. These include contracts, permit packets, data sheets, interconnection agreements, and other relevant documents. We published a full guide on what to do if your installer goes out of business that can be found here: https://www.solarinsure.com/what-happens-to-your-solar-panel-warranty-when-the-company-goes-out-of-business#solar-detect-by-solar-insure-for-residential-solar

Industry Resilience and Looking Forward

Despite these challenges, the solar industry demonstrates remarkable resilience and offers significant long-term benefits.

Resilience Factors:

- Technological advancements continue to make solar energy more efficient and cost-effective.

- Growing environmental consciousness and government incentives support the industry’s growth.

- Diversification in services and business models within the industry enhances its adaptability.

Conclusion

In conclusion, while the closure of several solar contractors in 2023 poses immediate challenges, the underlying strength and potential of the solar industry remain intact. Homeowners affected by these closures have avenues for support, and the long-term outlook for solar energy continues to be bright and promising.