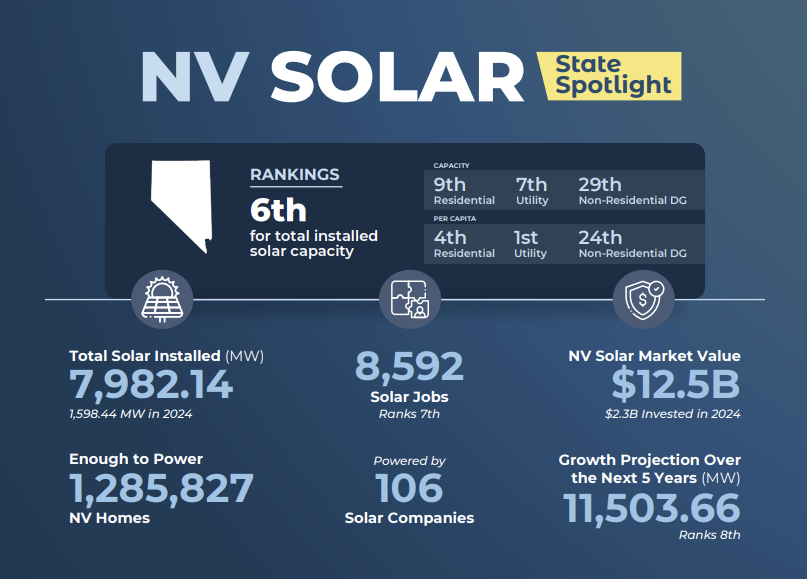

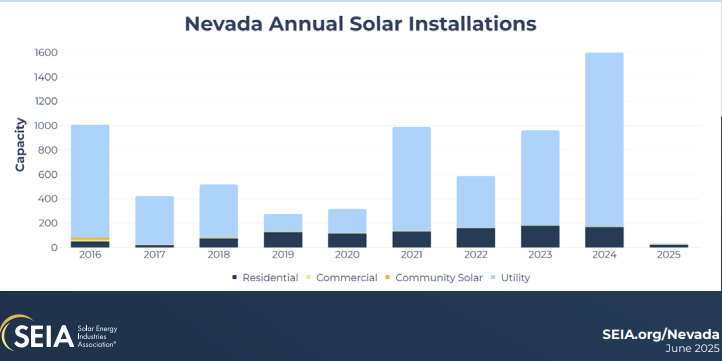

Nevada ranks #6 in total installed capacity and has an impressive 32% of its electricity generated by solar. Almost 17% of homes have solar panels, and the state’s utility-scale solar market has been booming since 2021. As for Nevada solar incentives, there aren’t many available to Nevada homeowners, but the state did implement new net metering policies in 2017 that are more friendly to homeowners.

However, with 250-300 sunny days per year, there is plenty of solar resource for homeowners to take advantage of. Nevada ratepayers have enjoyed the lowest percent change in electric rate in the country over the last ten years, with rates only increasing 6.19% from 2014-2024.

Below, we’ll discuss some of the Nevada solar incentives available to homeowners. You can find a full list of incentives by visiting https://programs.dsireusa.org/system/program/nc

Table of Contents

Federal Incentives

Federal Investment Tax Credit (ITC)

Residential solar and energy storage systems installed in North Carolina in 2025 are eligible for the Federal ITC, which provides up to 30% credit toward the total cost of a solar system.

The credit is non-refundable, meaning it cannot exceed the amount you owe in tax and would not directly increase any refund you would receive. Excess credit can be carried forward and used in future years.

Previous legislation had this credit available until 2032, but due to the passing of H.R. 1, “the big beautiful bill”, homeowners are only able to claim this credit if their system is installed before December 31st, 2025. Systems installed starting in 2026 will not be able to receive any federal solar tax credits. Learn more about the changes to the tax credit here.

Modified Accelerated Cost Recovery System (MACRS)

IRS section 179 depreciation allows certain qualified properties to be classified as 5-year properties, and tax credits are taken on the depreciation. This credit applies to commercial sites and certain investment properties. Specific information on what qualifies can be found on the IRS website.

State Incentives & Programs

Portfolio Energy Credits

The only Nevada solar incentive available to residential systems in Nevada is a Portfolio Energy Credit (PEC) Trading program. Similar to SRECs in other states, homes with solar with submit an application to track PECs and sell them to utilities in the state to help them meet Nevada’s Renewable Portfolio Standard. The RPS in Nevada targets 50% renewable energy by 2030.

Solar energy systems generate one PEC per kWh of energy generated. Systems installed in 2015 and before can generate 2.4 PECs per kWh. Those systems are also eligible for multipliers based on when they generate energy. The value of a PEC is market-driven rather than flat, so the value a home can receive varies.

Commercial and Utility-Scale Incentives

One of the reasons Nevada has such a booming commercial and utility-scale solar market is that many Nevada solar incentives in the state are only available to commercial and utility-scale installations. These projects can receive:

Net Metering

Nevada is an interesting case study for government reversing course in order to enact positive change in a market. In 2015, the Nevada legislature changed rules governing net energy metering policies that reduced the benefit for any power excess sent to the grid. The state’s solar installation volume dropped dramatically, and in 2017, the Public Utilities Commission of Nevada reinstated provisions to bring net metering back.

Since then, the Nevada solar market, especially in utility-scale, has been growing substantially and shows signs of continued growth.

The order by the Public Utilities Commission guarantees rooftop solar system owners are netted electricity monthly and credited between 75%-95% of the retail value for any power sent back out to the electric grid.

The Future of Solar in Nevada

Nevada solar will only continue to grow due to the abundance of sunshine available to consumers. Large-scale solar installations already make up a massive percentage of Nevada’s energy mix and are helping to keep energy rates low for ratepayers. If some of the Nevada solar incentives available to commercial solar systems become available to the residential sector, we’ll likely see a boom in residential solar in Nevada.