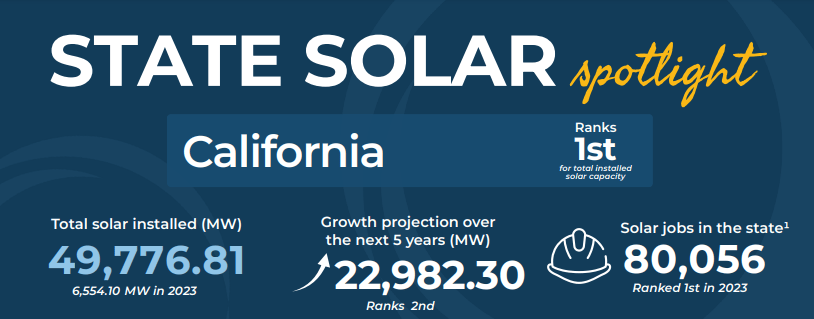

California has long been the center of the solar industry in the United States, even amid policy changes over the past few years that have dampened the market. Through Q3 of 2024, California ranks #1 in the US with 49,777 MW (49.7 GW) of installed solar capacity.

According to SEIA, The state boasts more than 2,400 operating solar companies and over 80,000 solar jobs. 31% of the state’s electricity is provided by solar energy. Since 2019, energy storage deployment has increased by 1,250% and California is the leading state for energy storage deployment.

Over the years, incentives and solar policies have come and gone, but several are still available today. Links to specific incentives are below, you can also find a list of incentives and policies at DSIRE.org.

Table of Contents

Federal Incentives

Federal Investment Tax Credit (ITC)

Residential solar systems installed in California are eligible for the Federal ITC, which provides up to 30% credit toward the total cost of a solar system. The Inflation Reduction Act (IRA) of 2022 extended the 30% credit through 2032. Starting in 2033, the ITC value will drop to 26% followed by a drop to 22% in 2034.

The credit is non-refundable meaning it cannot exceed the amount you owe in tax and would not directly increase any refund you would receive. Excess credit can be carried forward and used in future years.

The IRA also included standalone or retrofitted energy storage projects, so batteries added to the system’s quality for the 30% tax credit.

Modified Accelerated Cost Recovery System (MACRS)

IRS section 179 depreciation allows certain qualified properties to be classified as 5-year properties and tax credits are taken on the depreciation. This credit applies to commercial sites and certain investment properties. Specific information on what qualifies can be found on the IRS website.

State Incentives & Programs

Active Solar Energy System Exclusion

This incentive is a property tax exclusion for installing new active solar energy systems. Property tax would not be reassessed to increase or decrease due to the change in home value associated with the installation of a solar energy system.

Originally this incentive was set to expire starting in 2025 but has been extended to January 1st of 2027.

Self-Generation Incentive Program (SGIP)

The Self-Generation Incentive Program, also known as SGIP, offers upfront rebates for installing energy storage systems in some of the larger utilities in the state. Included in this incentive are:

- Pacific Gas & Electric (PG&E)

- Southern California Gas Company (SCG)

- Southern California Edison (SCE)

- San Diego Gas & Electric, run by the California Center for Sustainable Energy (CSE)

The program is a tiered incentive, meaning as more batteries are installed the incentive amount lowers. As of the time of writing this article, all four entities are in step 7 for small residential storage; providing $150/kWh ($0.15/Wh). If a home were to install a Tesla Powerwall with a capacity of 13.5 kWh, the incentive amount would be $2,025.

SGIP also includes increased incentive amounts for Equity projects and Equity Resiliency projects. Equity projects are single or multi-family homes in low-income areas and carry an incentive of $850/kWh ($0.85/Wh, currently all utilities in step 5)- Powerwall would receive $11,475.

Equity Resiliency projects are those located in low-income communities and in a High Fire Threat District. All four utilities are currently in Step 5 and would pay out $1000/kWh ($1.00/Wh)- meaning a Powerwall would receive $13,500.

There are numerous eligibility requirements, especially for Equity and Equity Resiliency, and the full list can be found on the SGIP website listed above.

Demand Side Grid Support

This program seeks to enroll customers into a Virtual Power Plant (VPP), where the battery capacity can be discharged during certain days and times of the year to curb periods of high grid demand. In exchange for enrolling your battery into the program and allowing discharge, yearly payments are made to the homeowner.

Notably, the program guidelines do not define the exact amount homeowners are paid, they leave that up to the homeowner and the VPP aggregator they are working with. Tesla advertises $350 annually for participation and Sunnova advertises $125 annually.

The aggregators are paid based on how much their total fleet discharges during the required windows. So aggregators with larger fleets like Tesla will typically pay more than those with smaller fleets.

To be eligible to participate homeowners must be part of a Publicly Owned Utility (POU), Federal Power Marketing Administration (FPMA), customer or a tribal utility, or part of a Community Choice Aggregator.

Disadvantaged Communities – Single Family Solar Homes (DAC-SASH)

The DAC-SASH program provides incentives to qualifying low-income homeowners within a disadvantaged community and is only available to residential customers. The program sets caps at 5kW AC system sizes but also says the program administrator GRID Alternatives can review a client’s energy to determine the maximum system size.

The program has requirements for installation standards, equipment standards, and warranty standards. If all eligibility requirements are met, DAC-SASH will pay out an incentive to cover most or all of the cost of the system.

Net Metering

The majority of California utilities currently offer Net Energy Metering 3.0, more commonly referred to as NEM 3.0. NEM 3.0 gutted the rate solar homeowners received for power sent back to the utility grids.

NEM 3.0 was officially adopted for any projects installed on or after April 15th, 2023. Previously, NEM 2.0 ran from July 2017 through April 2023, and before 2017 NEM 1.0 was available.

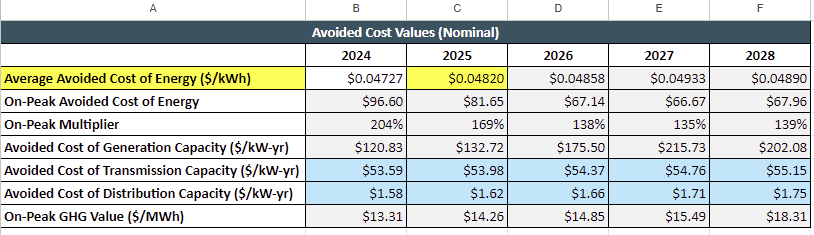

As of August 2024, California boasted an average electric rate of $0.3105/kWh, with on-peak rates climbing even higher. Under NEM 3.0, homeowners are credited a rate based on an Avoided Cost Calculator that averages monthly values for each hour and differentiates between weekdays and weekends.

Per the latest version of the ACC, the current net billing value paid to homeowners is about $0.047/kWh.

With rates that low, NEM 3.0 has heavily pushed battery adoption in the state. With battery storage, homeowners can store excess energy for later use in their homes rather than waste it by sending it to the grid.

Some smaller utilities in the state offer alternatives to NEM 3.0. Customers of the Los Angeles Department of Water and Power (LADWP) can still get full retail rate net metering. Customers of the Sacramento Municipal Utility District can enroll in the Solar and Storage Rate, which pays roughly $0.07/kWh for power sent back to the grid.

Solar In California

Despite policy changes California remains a top state for solar and battery adoption with no sign of slowing down soon. For more information on these incentives and information specific to an individual’s home or situation, visit the program websites or speak to your solar provider.